2 Important Changes to QuickBooks Basic Payroll You Need to Know

Most people are used to regular updates being pushed out by software manufacturers. These changes typically address security issues or enhance features. It is rare when a company removes features. However, as tax season is upon us, this is exactly what happened to our QuickBooks Basic Payroll subscription after recently installing QuickBooks updates.

This post discusses the features that were removed from the Basic Payroll subscription associated with QuickBooks Desktop. The removed features are now only available after paying to upgrade to an Enhanced Payroll subscription. It is important to share that I specifically held off on running updates outside of payroll updates, for some time. As a result, I cannot say for sure when these changes were implemented, only that they are recent to my situation.

NOTE: The changes we experienced may not be the same for all users. One of the most frustrating aspects of the changes is that we were not aware of receiving any notice of the changes and found out only after being denied access. If you still have access to the features discussed below, be careful running updates as you might lose access if you run all available updates.

2 Important Changes to QuickBooks Basic Payroll You Need to Know

First, some background

We have been using QuickBooks Basic Payroll for our business for a decade. Last year I purchased the current year software upgrade which included an annual subscription to the Basic Payroll service. I contacted support to get my annual license activated, as it cannot be done any other way, but unfortunately, 30 days later my license "expired" and payroll quit working.

I contacted support to report the issue and was given a 30-day trial to use until the issue was "resolved". Fast forward to today, and I spent 1-1.5 hours each month for 11 months just to end up with another new 30-day trial key so I could run payroll for the last year. Along the way I suffered the following additional problems, which does not include the time I wasted getting a new trial key or going through the same troubleshooting steps over and over without resolution:

- Corrupted paycheck records - these had to be deleted and re-created so my books were accurate, which is a very time consuming process and requires documenting all the data before deleting.

- Failed direct deposit - having to print all paychecks each month.

- Losing the ability to submit quarterly reports to the IRS - having to print and mail these because the digital submission was broke.

- Being overcharged - getting charged for a monthly payroll subscription automatically after my "trial expired" even though I had paid for an annual plan. Then being forced to contact support once again to get the charges reversed.

- Wasting time trying to pressure me into upgrading - many times support tried to convince me to switch to their "monthly payroll subscription to fix my issue" at a cost of around $600 a year (for a subscription I ALREADY PAID FOR) and being offered $0 credit for my existing subscription.

These are issues I experienced over an 11 month period. Fixing each ranged from thirty minutes to several hours and yet none ever fixed my original issue! Unfortunately, I was left with little choice as I could not risk being late on submitting a form to the state or government, nor was I willing to have inaccurate records because their software kept corrupting other parts of the software.

With that background in mind, I will share with you the changes that the last few QuickBooks updates made to my Basic Payroll service. After looking at the webpage discussing what their Basic Payroll service includes, it is clear these changes are intentional and if you still have the ability to use the features discussed below, you probably won't for long.

On to the changes...

Reports

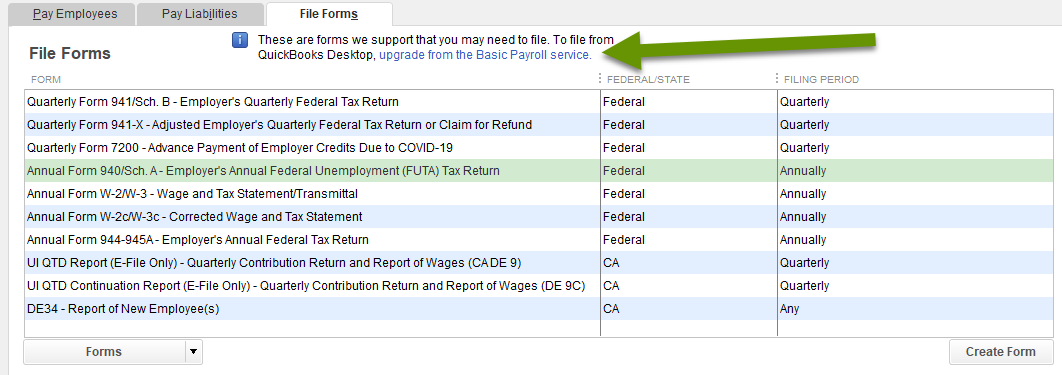

As mentioned in the list above, one of the times my payroll key was updated, the ability to submit 941 reports to the IRS broke. This meant I was forced to figure out how to submit my quarterly report another way. Luckily, I found an easy solution which was to print the report from within the "File Forms" tab in the Payroll portion of QuickBooks. Once printed, I simply had to mail in the form.

Unfortunately, this month, when I went to the same area in QuickBooks, I could not open or generate any payroll reports. Instead, I was prompted to upgrade to Enhanced Payroll for the ability to generate the same reports I have been able to generate for a decade using the Basic Payroll service!

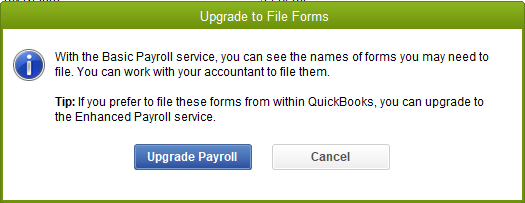

Now when I select the name of a form and click the "Create Form" button, I get the following pop-up encouraging me to upgrade my subscription type.

This means I cannot generate the report from this screen to print and mail in anymore either. Instead, I need to use a third-party service where I can enter data acquired through the Reports tab which the company then submits to the IRS. This is of course if I choose not to upgrade to QuickBooks Enhanced Payroll, which I personally will not.

Employee W-2 Forms

Printing W-2 forms for employees has been, up until now, a process that required only about 15 minutes of my time. After running all of my payroll through QuickBooks, the records are there and QuickBooks would consolidate that information into a W-2 with the click of a button.

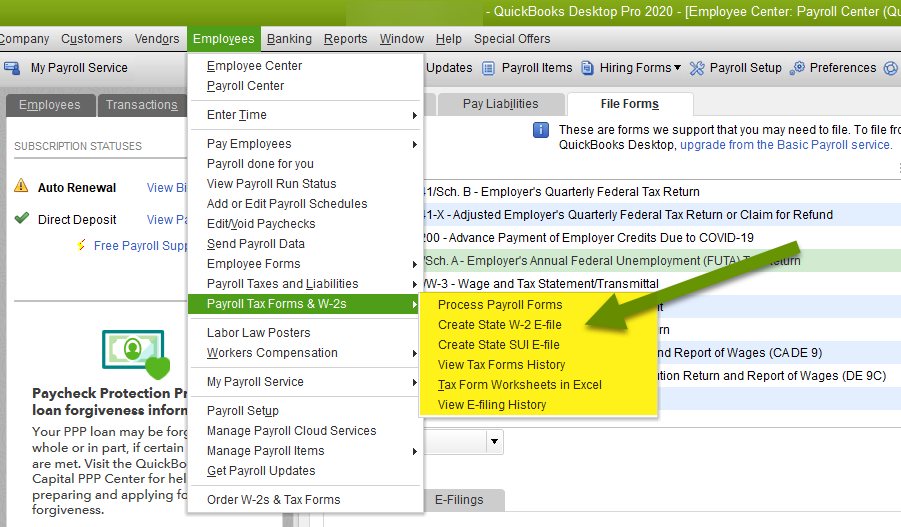

Now, when I expand the "Payroll Tax Forms & W-2s" menu, I no longer have an item for creating and printing employee W-2 forms. This matches the section pictured above, where W-2s are listed in the reports menu and reports are no longer available with my subscription type.

As in the example above, there are other options. There are several services that allow you to enter employee data into their online forms or locally installed software which then generate and print either blank or IRS approved pre-printed W-2 forms.

Luckily, all the information needed to generate employee W-2 forms exists within the default reports under the Employees and Payroll tab in the Reports drop-down menu. Another option is to key employee information into the IRS website and generate and print W-2s from their site directly, which appeared to be free.

The takeaway

Even when you have downloaded and installed a third-party software application onto your local computer, that does not mean it will always remain the same. Changes and updates can still be pushed out by the vendor at any time. Sometimes these changes will include removing features, like the examples shown above in QuickBooks Basic Payroll.

This is another reason why it is important to start early on any project you have that is time sensitive. It might not be as important as getting W-2 forms to employees, but if you start early and run into a software snag, you have more time to adapt, to find a solution or work-around, if you begin earlier. This means you are less likely to be held hostage by the software manufacturer into paying for upgrades you might not want or truly need.

As always, we are often reliant upon third-party software to accomplish specific tasks, but that doesn't mean we don't still have choices.